Electricity in Southern Africa- The elephant in the (South African) room or The “Power” of positive thinking.

Incidental coincidences this month of February 2022 as the latest WoW report on electricity generation in Southern Africa was released; the IMF report (11 Feb) highlighting challenges to be addressed by Eskom and the President of the Republic of South Africa, Mr. Ramaphosa’s State of the Nation address (SONA) on the 10th of February also emphasising the importance of electricity generation as a catalyst or impediment to economic growth.

Eskom and its problems have practically been in the news daily and in an intensifying manner for the last 13 years. It started with the first “load shedding” in 2007.

Electricity non-availability and its constricting grip on growth, is a stark reality for the next 3 – 5 years. The polite but unequivocal wording of the IMF report on the urgency for Eskom address a few challenges and free up the generation sector may have been behind the top ranking of the issue in the SONA. The IMF report summed up the challenges to be resolved as “Overemployed, Overpaid, Under-skilled, Over-indebted and Under-capacitated”

Global economies have been “Disrupted” to a great extent by technology; however, South Africa can do with some disruption in the Eskom stable. Eskom and the Department of Minerals and Energy started the discussion about the introduction of new entrants in the electricity generation market for more than a decade and it was only in 2021 that President Ramaphosa announced the 100 MW independent generation capacity, which was also delayed by state and Nersa’s bureaucracy that further stifled industries.

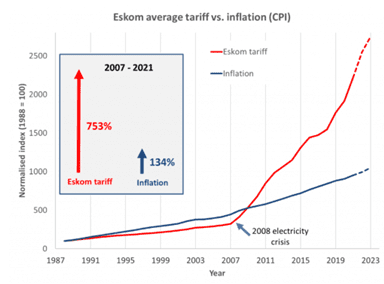

We are of the view that economic growth derives from productivity and conditional volume growth NOT cost increases. Excessive price increases have a negative effect on industry and the economy as it pushes inflation higher and hinders competitiveness.

The graph across clearly illustrates the positive contribution made to the economy by Eskom from 1991 to 2007 (cost effective pricing and increasing volumes) , and the accelerating negative contribution thereafter (forever higher pricing and decreasing volumes).

As narrated in the latest WoW report on Electricity generation, Eskom’s problems have inadvertently affected the whole of the SADC region by the sheer size of its GDP. The Southern African Power Pool established in 1995 for the supply and distribution of electricity in the region was materially affected. In the nineties Eskom was going to light up Africa, and exported electricity to many countries. It powered the Mozal Aluminum smelter and afforded the Hillside aluminum smelters in Richards Bay a thriving export hub, lately negatively disrupted by Eskom’s pricing.

In 2021 alone South Africa had 650 hours, that’s as good as a month, of load shedding and was unable to feed the international grid. Angola, Tanzania and Mozambique started investing in power generation but are still short of capacity.

South Africa has had several “Integrated energy planning frameworks” but so far since 2007 no efficient cost effective new power generation is in sight.

According to reports published prior to the pandemic, Southern African countries had extensive plans for installing additional generation capacity which will increase the size of the industry if they go ahead but not all planned expansion was achieved. In fact all southern African countries planned capacity is lagging behind and net capacity has declined in recent years.

National Energy Regulator of South Africa (Nersa) in its principles document on electricity supply prices appears biased in supporting tariff structures that support Eskom rather than transition to promoting renewables. Transition to a more sustainable energy mix has to be gradual but it has to happen. It also should not rob people who invest in renewables like solar power with prohibitive tariffs. The high cost of administered pricing and rising inflation is enough of a burden; removing discretionary income hinders economic growth.

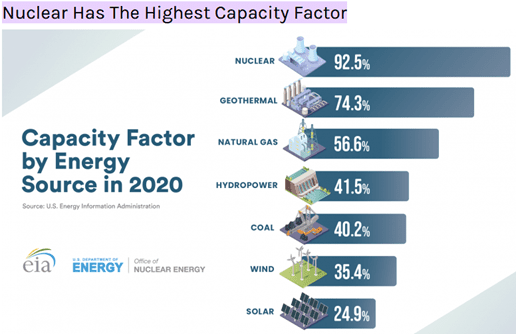

Southern African countries need to carefully select sustainable strategies for their energy mix and act on them if they wish to drive economic growth. Some energy experts believe that Nuclear energy should be part of a best solution and the diagram below seems to support that notion. Which ever way, decisions need to be made and acted upon fast.

Contact us to access WOW's quality research on African industries and business

Contact UsRelated Articles

BlogCountries Electricity gas steam and air conditioning supplySouth Africa

The possibility of a power shift from Eskom and renewables producers in South Africa

Contents [hide] One cannot discuss the South Africa power crisis and electricity generation without focusing on Eskom, a longtime monopoly operator that remains the dominant supplier. The organisation is a...

BlogCountries Electricity gas steam and air conditioning supplySouth Africa

South Africa’s Maritime Sector: Growth, Green Tech & Global Competition

Contents [hide] There is no doubt that the maritime transport sector is an important keg in the South African economic wheel. According to the Who Owns Whom report on maritime...

BlogCountries Electricity gas steam and air conditioning supplySouth Africa

The Energy Sector in Namibia: Projects, Investment & the Drive for 80 % Local Supply

Contents [hide] Namibia’s move towards reducing energy import dependency Who Owns Whom’s report on the energy sector in Namibia highlights the country’s forward-looking economic development policy addressing its dependency on...