The boom and bottleneck in South Africa’s building installation industry

South Africa’s construction sector has been in decline for many years, with several high-profile listed companies filing for business rescue or liquidation. Large, complex infrastructure projects have followed suit as South Africa gradually lost its critical skills and, therefore, competitiveness.

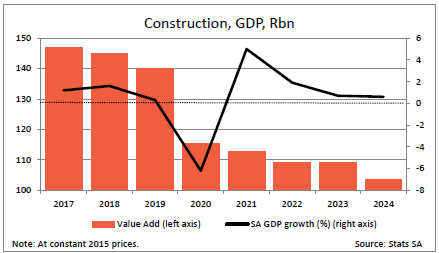

This is not a great way to start a story, but the graph below from the Who Owns Whom report on the building installation industry in South Africa cannot be ignored.

How South Africa compares with international competitors

Over several years, South Africa’s spend on construction has averaged 2.5%, of GDP declining from a peak in 2017 of 4% to 2.3% by 2023. This is far below the average of 6-9% in developed countries and a range of 10-20% in developing countries

The 7.5% shortfall, equivalent to R547bn, has resulted in astronomical job losses, stalled infrastructure projects, and declining maintenance of infrastructure, and as a result, fewer services delivered to citizens.

The country is far behind international practice in terms of average spending on construction. The government revealed a significant gap in the budget that it tried to fill by increasing VAT, but it failed, while spending its tax revenue excessively on wages and social grants, leaving insufficient funds for capital projects.

However, the growing demand for renewable energy installations, mainly in real estate development and heating and air-conditioning upgrades for commercial properties, has opened new opportunities in the building installation sector. Like its international competitors, South Africa’s renewable energy drive offers growth opportunities for building installations.

What is holding the construction sector back?

The private sector has made a significant contribution to the construction sector over the last decade, spending twice as much as the public sector. Most of the private sector investment goes to residential housing, yet the shortage of housing is estimated at 2.2 million homes. The shortage is most severe in the middle-income segment, which is people earning too much for an RDP house, but not enough to qualify for a mortgage.

The supply-demand mismatch in this segment is aggravated by several important factors.

External cost escalations

The cost of construction is held back by inordinate and burdensome regulations and approvals, and the costs of bulk supply upgrades and increased regulations which are all loaded into the price of new homes, making them out of reach for many.

Cost of money

South Africa’s interest rates have been high, and some economists have argued that South Africa’s inflation is not demand-driven like, for example, the US. South Africa’s inflation rate was 3% in June, and the US was 2.9%, yet mortgage rates in the US are around 5.9% while South Africa’s home loan rates are around 10.75%.

The difference in the bond rates increases the monthly bond payment on a R500,000 home by R1,522, meaning a person would need to earn R5,075 more each month to qualify for a bond, an amount that puts homeownership out of reach for many middle-income earners.

The stability of the rand as the cornerstone of interest rate policy is a valid goal but shouldn’t be the only focus.

High interest rates attract short-term speculative investment but haven’t stopped the rand from weakening against major currencies such as the euro, pound, and yuan over the past year, and against the US dollar if a longer period is considered. Meanwhile, these high rates continue to strangle economic activity for both the private sector and government.

Benefits of a change in policy

The construction sector, which includes many budding, small, and medium enterprises that can greatly contribute to job creation, is in dire need of accessible and affordable funding, as well as reduced red tape. Supportive policies can accelerate construction activity, drive innovation and move the country out of economic stagnation with better infrastructure, improved services, more affordable housing, and higher GDP growth.

The future demand for renewable energy is going to require massive investment in South Africa. Deregulation and liberalisation of the market will create an impactful boom for the construction industry, generation plants, new and upgraded transmission lines and hopefully distribute more affordable energy to South Africans.

Contact us to access WOW's quality research on African industries and business

Contact UsRelated Articles

BlogCountries ConstructionSouth Africa

The Impact of Infrastructure Development Challenges in South Africa

Contents [hide] The importance of capital formation for infrastructure development Infrastructure development has many elements including fixed capital formation, a statistical term for just about everything that constitutes investment in...

BlogCountries ConstructionSouth Africa

Nanotechnology in the Paints and Coatings Industry

Contents [hide] What is Nanotechnology? Nanotechnology is one of those many new technology buzzwords that are accepted in daily discourse but not very well understood as the magnitude is outside...

BlogCountries ConstructionSouth Africa

Advantages of Vertical Integration in the South African Tile Industry

Contents [hide] As covered in the WOW report on the Tile Industry in South Africa, the advantages of vertical integration in the tile industry relate to the fundamental principles of...