Blog

Administrative and support activitiesSouth Africa

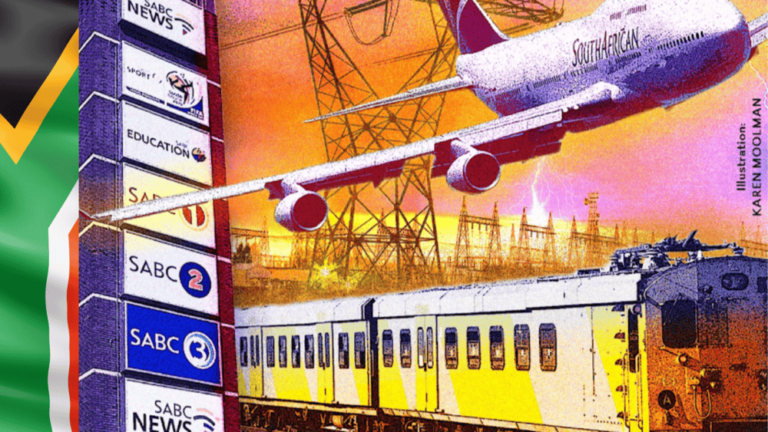

State-owned enterprises in South Africa – a sword of Damocles for the fiscus

Contents [hide] As articulated in the Who Owns Whom report on South Africa’s SOEs , the major SOEs’ total asset value (financial and non-financial) rose by 2.1 % to R1.65...

Public administration and defence compulsory social securitySouth Africa

South Africa’s security industry: A puzzle worth unravelling

No one can build his security upon the nobleness of another person” – Willa Cather Contents [hide] Security is an integral part of society, yet it is often taken for...

Electricity gas steam and air conditioning supplySouth Africa

South Africa’s Maritime Sector: Growth, Green Tech & Global Competition

Contents [hide] There is no doubt that the maritime transport sector is an important keg in the South African economic wheel. According to the Who Owns Whom report on maritime...

Agriculture forestry and fishingSouth Africa

South Africa’s Tea & Coffee Market 2025: Price Shocks, Café Boom & Export Wins

Contents [hide] Anyone who remembers the competition between Betamax and VHS will know that VHS won the day, not because it had better technology. The same phenomenon is evident in...

Human health and social work activitiesSouth Africa

The cleaning products industry – trends and sustainability

Contents [hide] Making soap is a simple process of adding caustic soda to water and mixing it with oil, yet the industry has become one of the most essential and...

Electricity gas steam and air conditioning supplySouth Africa

The Energy Sector in Namibia: Projects, Investment & the Drive for 80 % Local Supply

Contents [hide] Namibia’s move towards reducing energy import dependency Who Owns Whom’s report on the energy sector in Namibia highlights the country’s forward-looking economic development policy addressing its dependency on...

Arts entertainment and recreationSouth Africa

The event management industry in South Africa and the impact of technology and geopolitical shifts

Contents [hide] Events such as conferences were organised very differently in the 1990s compared to now. Simple examples such as confirming attendance and enhancing value for delegates have resulted in...

South AfricaWholesale and retail trade repair of motor vehicles and motorcycles

South Africa’s Food Retail & Wholesale Market 2025: Growth, Trends, and Challenges

Contents [hide] Who Owns Whom’s report on the wholesale and retail of food in South Africa highlights critical shifts in the industry amid ongoing debates about VAT increases. With food...